Washington State Estate Tax Exemption for 2023

Remind me, does Washington have an inheritance or estate tax?

Washington does not have an inheritance tax, but there is a Washington State Estate Tax .

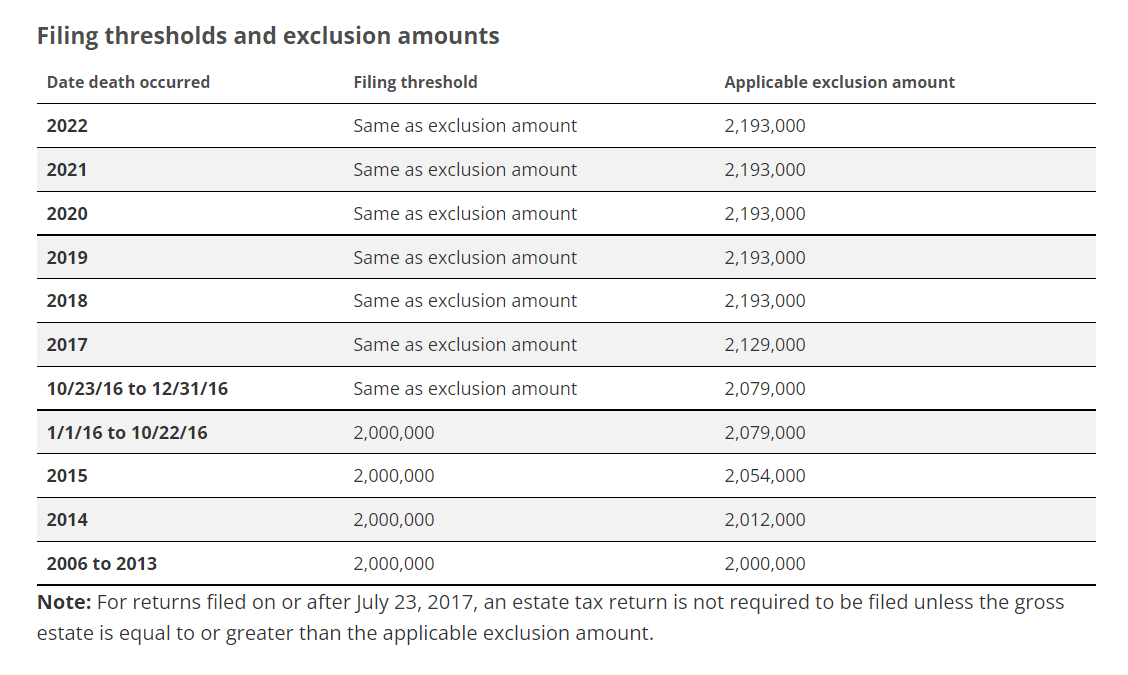

Estate tax rates in Washington state are progressive, ranging from 10% to 20%. The estate tax in Washington applies to estates with a value of $2.193 million and above. If you live in Washington, this article goes through everything you need to know about estate planning. You might want to contact a financial advisor if you believe your estate will be subject to the estate tax.

The government also made other adjustments to meet the new requirements. In November 1981, voters rejected an inheritance tax and adopted a death tax. The transition from an inheritance to a death tax took effect on January 1, 1982. Washington no longer has an exemption from the inheritance tax due to this modification.

Washington State Estate Tax Exemption for 2023

The federal annual gift tax exclusion amount will rise to $16,000 in 2023, up from $15,000. The federal estate and gift tax exemption amount will be increased from $11.7 million to $12.06 million per individual in 2023. This piece will look at the modifications to Washington State Estate Taxes for 2023 .

In general, an inheritance tax is a tax imposed on the beneficiaries of an estate, whereas an estate tax is a tax applied to the estate itself.

If you live in Washington and inherit property or money, you are not required to pay taxes on your inheritance.

FYI: There have been no significant changes for tax year 2023.

The Washington State Estate Tax applies to the value of a person’s estate when it is greater than the specified exclusion amount in RCW 83.100.

According to Washington’s estate tax tables, the appropriate exclusion amount increased by several thousand dollars annually between 2013 and 2018 before gradually stopping. For the year 2023, the exemption amount is $2.193 million, as it was in previous years. This value has stayed the same since 2018. So what’s going on?

In conjunction with the consumer price index, which is defined in subsection (b) as the consumer price index for the Seattle-Tacoma-Bremerton area, which the US Bureau of Labor Statistics calculates, this estate tax exclusion amount was always intended to rise in tandem.

Notes on the Bureau of Labor Statistics

The issue is that, in 2018, the Bureau of Labor Statistics discontinued calculating the consumer price index for the Seattle-Tacoma-Bellevue area and switched to using the Seattle-Tacoma-Bellevue consumer price index.

As a result, Washington taxable estates cannot adjust their RCW 83.100 exemption amount until the Bureau of Labor Statistics produces a new consumer price index for the Seattle-Tacoma-Bremerton area.

To avoid this problem in the future, the Washington State Legislature could pass a law that would adjust the estate tax exemption amount according to changes in the consumer price index for all urban consumers in Washington, as published by the United States Bureau of Labor Statistics.

In the meantime, if you have questions about estate planning in Washington State or any other state, please contact a qualified estate planning attorney. Estate taxes can be complex, and it’s essential to seek professional help to ensure your estate is properly planned and structured. People who live in Washington with assets greater than or equal to the permitted exclusion amount should contact an estate planning attorney about their estate tax preparation alternatives, which may include gifting, a testamentary trust funded on the death of a spouse, or a combination of both.

If you have any questions about inheritance tax or Washington State Estate Tax, Idaho, or any other estate planning matters, please contact our qualified estate planning attorneys at 509-328-2150 .

SmartAsset offers a further deep dive into Washington State estate taxes.